- Home

- Personal Finance Tools

- Financial Statement Template

Financial Statement Template to Master Money Management

Using our financial statement template, you can quickly conduct a full financial inventory - identifying all assets, liabilities, sources of income and expenditures.

In Step Three of our 10 Steps to Conquer Debt eBook , you will complete a Personal Financial Statement.

Our free template provides more than a simple financial statement. We have created a unique format for organizing your financial information, which makes this a more valuable tool - more on that in a minute.

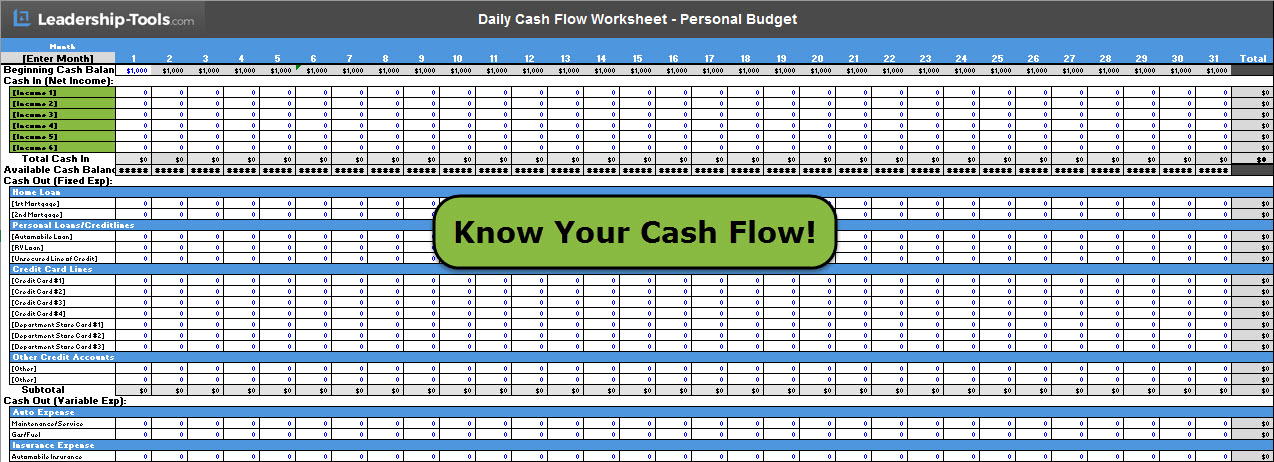

Think of your financial statement as a snap-shot in time. Only at the time you complete the form are the values you write down 100% accurate.

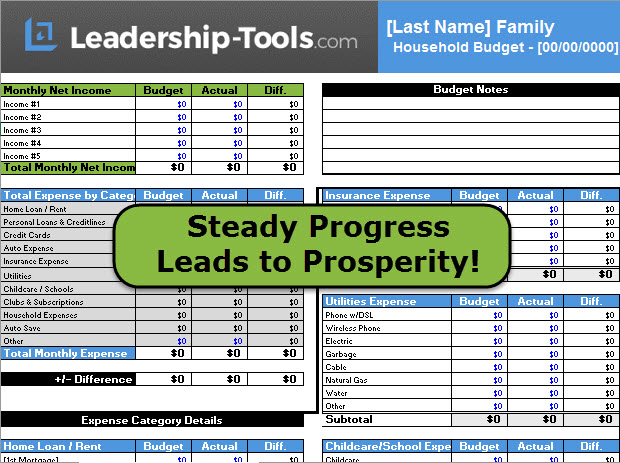

For example, balances in various accounts can change daily so it is important that you update your personal financial statement monthly to track your progress. Each time you update our financial statement template, compare it to the prior month's statement to learn if you are moving in the right direction or not.

The most common obstacle people face in completing this step is... DENIAL.

"Your net worth to the world is usually determined by what remains after your bad habits are subtracted from your good ones."

- Benjamin Franklin

People simply don't want to admit that their financial troubles are as bad as they really are. These people know deep-down that if they complete the process of accounting for every dime of income and debt, they will finally have to face the truth about their poor spending habits.

NO MORE DOUBTS, FEARS, WORRY or DENIAL.

If you want your money problems to change; if you truly want financial help; if you wish to learn effective budgeting guidelines - then it's time to face your fears, right here and right now.

Now is the time to get clear and specific about your financial condition.

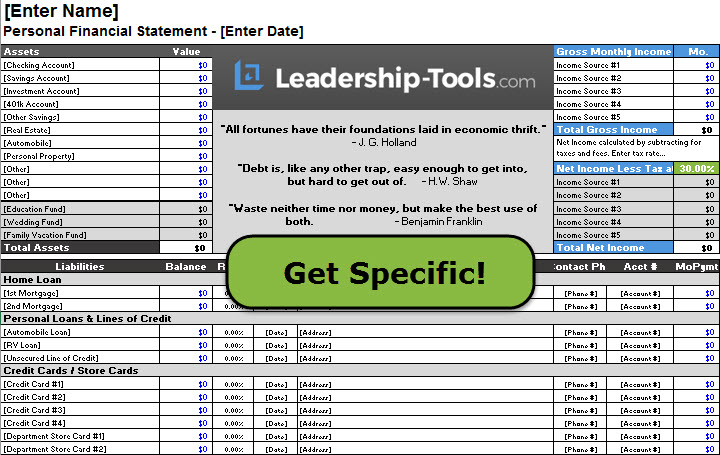

Once you download the Personal Financial Statement template, you will see exactly what we mean by "getting specific".

Take Inventory Using Our Financial Statement Template

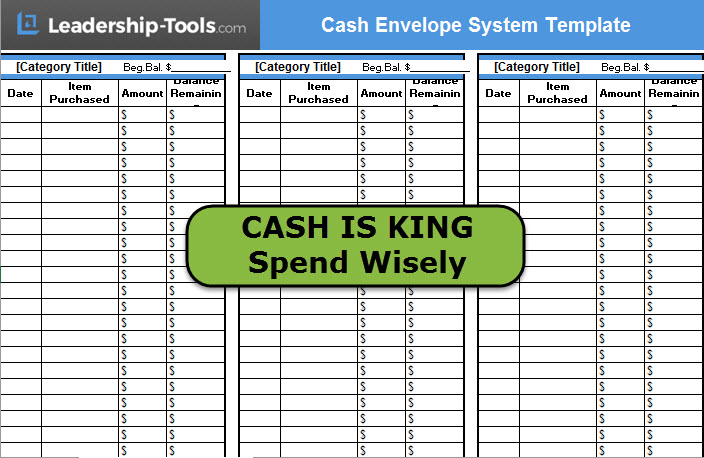

The following template was created to assist you in taking a complete inventory of your personal fiances. Once completed, you will have an easy reference tool for all your financial accounts on one page. This free tool is available in our Leadership Tools library, which is accessible to subscribers of our free newsletter.

Organize Personal Finances for Major Benefits

Our personal financial statement template requires you to fill in a substantial amount of financial data. Yes, this exercise will take some time, but it’s well worth the effort so commit yourself to fully completing the form.

Financial information will include:

- Account names

- Addresses

- Phone Numbers

- Terms of Payment & Payment Amounts

- Payment Due Dates

- Interest Rates

- Account Balances

- Account Numbers

Once you have all the above information on one sheet - you will never again be caught off-guard about detail of your finances.

Imagine if your identification is stolen. By accessing financial account and contact information immediately you'll be able to quickly call creditors to close and re-issue your credit cards and financial accounts and minimize the monetary risk or damage. This benefit alone makes our personal financial statement an invaluable tool.

In addition, there is tremendous value in the confidence you gain, knowing that you are now back in control of your financial destiny.

By taking personal responsibility of your finances you are immediately increasing your ability to take full advantage of future opportunities as they arise. By having a clear picture of your financial condition, you will be better prepared to make thoughtful decisions regarding our finances.

"Make a decision to be successful right now. Most people never decide to be wealthy and that is why they retire poor."

- Brian Tracy

The purpose of completing a personal financial statement is to arm you with the knowledge you need to better manage your money; to expand your ability to overcome financial challenges, and improve the overall condition of your life.

Many highly successful people have said that the best thing that ever happened to them was "failing". Somehow these folks took what they learned from their failure and pushed forward to achieve amazing success.

Unfortunately, many people don’t bounce back from a major failure. They get stuck in their self-imposed prisons and continue to let failure punish be an excuse for more of the same.

The only difference between the successful and unsuccessful man or woman, is the CHOICE they make in how to respond to failure.

The successful person works to discover why he failed, and then takes a new approach to avoid making the same mistake the next time around. The unsuccessful person wallows in his failure and never works to identify the reasons why he failed.

"He who will not economize will have to agonize."

- Confucius

Being deep in debt represents a failure to properly manage your money, but that does not mean you are a failure. Whether you fail in life or not depends on whether you have decided to quit trying to achieve greater success!

Our personal financial statement tool will help you to identify financial shortcomings and assist you in learning from your past mistakes.

Hopefully, you are getting excited about changing your financial situation and are leaning into the first few steps.

Stay focused on the goal of conquering your debt and increasing your income. Making this one choice has the potential of changing your life, and the lives of your family members, for years to come.

Download 10 Steps to Conquer Debt eBook

To download our free 10 Steps to Conquer Debt eBook, simply subscribe to our free newsletter.

You will immediately receive a password that grants access to our entire leadership tools library, including the Personal Financial Statement template. Don't put this off. Completing a financial statement is very straightforward. Begin getting your financial life in order today.

Your privacy is important to us. We never share or sell email addresses.