- Home

- Leading Self

- 10 Steps to Conquer Debt

- Household Budget Template

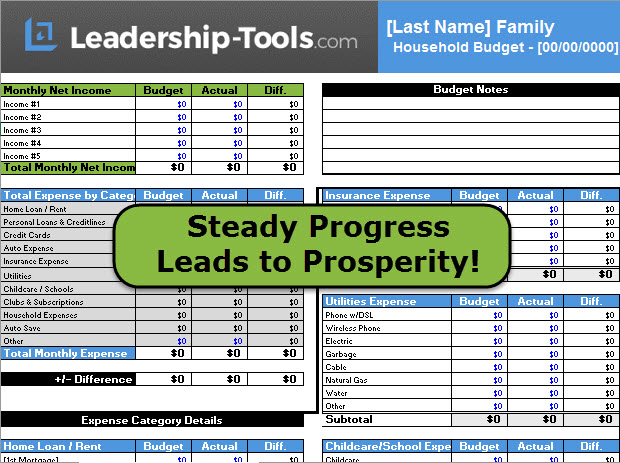

Household Budget Template for Monthly Debt Reduction

Our household budget template tool helps you to account for all your monthly expenditures such as food, utilities, and other household related costs.

Download Household Budgeting Template: PDF | Excel File

Real leaders don’t wait for their financial situation to “fix itself.” They take ownership, get clear on the numbers, and create a simple system they can follow.

That’s exactly what this free budgeting template is designed to help you do.

At Leadership-Tools.com, this tool is one step in our free ebook, “10 Steps to Conquer Debt,” which is part of our self-leadership resource library. The template you’re about to download isn’t just a spreadsheet – it’s one of the practical leadership tools you’ll use to take control of your finances, reduce debt, and create more freedom in your life.

Jump To: Download Template |What You Need |How to Use | Why This Matters | Create a Habit | Big Picture

Your new household budget spreadsheet, or personal budget planner as some people prefer to call it, is a critical tool in your new financial arsenal.

"The cold harsh reality is that we have to balance the budget."

- Michael Bloomberg

You are encouraged to take the time necessary for budgeting every line item on a monthly basis.

The great news here is that much of the hard work is already done.

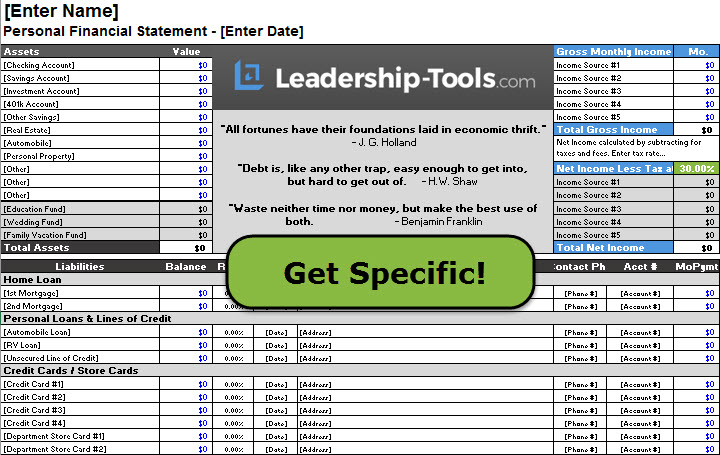

This step won't take very long to complete since you already have most of the data at your fingertips from completing your personal financial statement during Step Three.

Download Household Budget Template

Using our household budget template, you now possess the means of planning in advance an entire month of finances. As soon as you've subscribed to The Leadership-Tools Free Newsletter, you have access to our entire leadership library.

Don’t make the mistake of underestimating the value of this tool. By tracking all revenue and expenses to a monthly budget, you will greatly increase your chance of paying off your debt and begin building financial wealth.

Download Household Budget Template: PDF | Excel File

Before You Begin: Here's What You'll Need

This household budget template is most effective when you come to it prepared. You don’t need perfect records or advanced math skills – just honest numbers and a willingness to lead yourself through the process.

Take 5–10 minutes to gather the following materials:

Your Monthly Take-Home Income

- Paychecks (after tax)

- Side income (freelance, gig work, part-time jobs)

- Regular benefits or support payments

Your Regular Fixed Expenses

- Rent or mortgage

- Utilities (electricity, water, gas, internet)

- Insurance (auto, home, health, life)

- Loan payments (car, student loans, personal loans)

- Subscriptions (streaming, memberships, software)

Your Variable Expenses (refer to past bank statements - these are often eye-opening when added up)

- Groceries

- Eating out and takeout

- Gas and transportation

- Entertainment and hobbies

- Clothing and personal care

- “Little extras” that add up over the month

Think about your financial priorities and goals

- How much you want to save each month

- Debts you want to eliminate faster

- Short-term goals (vacation, emergency fund, home projects)

- Long-term goals (retirement, education, financial independence)

Don’t get stuck trying to be perfect. Self-leadership means starting with your best estimate and improving it as you go. Your first draft budget is exactly that – a draft.

How to Use This Budget as a Self-Leadership Tool

This template is more than a place to record numbers. It’s a leadership tool that helps you make better decisions, stay accountable, and follow through on your “10 Steps to Conquer Debt” plan.

Follow these steps the first time you use it, and you’ll have a working household budget in about 15–20 minutes.

Step 1: Enter Your Income

Start in the “Income” section of the template.

- List each source of take-home income separately.

- If your income varies, use a conservative monthly average based on the last 3–6 months.

- In Excel the worksheet will total your income for you.

Leadership outcome: You gain clear awareness of how much you actually have to work with each month – a basic but powerful leadership fact.

Step 2: Record Your Fixed Expenses

Next, move to “Fixed Expenses.”

- Enter all regular monthly bills: housing, utilities, insurance, minimum debt payments, subscriptions.

- For annual or semi-annual bills, divide the total by 12 and enter that monthly amount.

- Be sure to include every recurring commitment.

Leadership outcome: You see how much of your income is already spoken for before you spend on anything else.

Step 3: Estimate Your Variable Spending

Now fill in “Variable Expenses.”

- Groceries, gas, eating out, entertainment, clothing, personal care, etc.

- If you’re unsure, refer to past bank statements, then track actual spending for a month and update.

- Be honest with yourself. Underestimating here is the main reason budgets “don’t work.”

Leadership outcome: You uncover the spending patterns that quietly drain your financial strength each month.

Step 4: Assign Money to Savings and Debt Reduction

This is where your budget connects directly to the “Conquer Debt” goal.

- Add lines for “Emergency Savings,” “Extra Debt Payment,” and any key goals from your 10-step plan.

- Decide how much you can realistically assign to each goal every month.

- Make sure your total expenses plus savings and debt goals stay at or below your total income.

Leadership outcome: Instead of hoping your goals work out, you give them a clear, monthly line item – and you lead your money, rather than letting it lead you.

Step 5: Review the Summary and Make Adjustments

Your template should now show:

- Total Monthly Income

- Total Monthly Expenses

- The Difference (Surplus or Shortage)

If you have a surplus (income > expenses):

- Decide where that extra money will go: more savings, faster debt payoff, or both.

If you have a shortage (expenses > income):

- Start by trimming variable categories: eating out, entertainment, non-essential shopping.

- If needed, look at bigger changes over time: housing, transportation, or subscriptions.

Leadership outcome: You’re no longer in the dark. You’re making conscious, informed trade-offs aligned with your goals.

Step 6: Build a Simple Weekly Budget Ritual

A one-time budget is a document. A regularly reviewed budget is a leadership habit.

Once a week:

- Open your household budget file in Excel.

- Update what you’ve actually spent in each category.

- Compare your plan to reality and adjust your spending for the rest of the month.

This 10 to 15-minute check-in is where real change happens. It’s a small act of self-leadership that adds up to major results over time.

Why This One Step Matters in the 10 Steps to Conquer Debt

Our “10 Steps to Conquer Debt” ebook walks you through a complete, practical process for getting out of debt and staying out of debt. The household budget template is one of those critical steps because it ties so many others together.

Here’s why this tool is so important in the bigger system:

It gives you clarity and control. Most people don’t have a money problem – they have a lack-of-clarity problem. This template shows you, in black and white, where your money is going and what needs to change.

It makes every other step more effective. Whether you’re negotiating lower interest rates, building an emergency fund, or creating a realistic payoff plan, your budget tells you what’s possible and how fast you can move.

It turns financial goals into a monthly action plan. Goals like “pay off debt” or “build savings” only have power when they’re linked to specific monthly amounts in your budget. This template is where that connection happens.

It develops your self-leadership muscles. Using this tool consistently reinforces key leadership habits:

- Telling yourself the truth about your situation

- Making clear decisions based on facts

- Following through on commitments, even when it’s not easy

It works in real-life situations. The template is designed to be flexible enough for different seasons of life:

- Single or married

- Families with kids

- Irregular income or multiple jobs

- Growing businesses and changing responsibilities

As your life changes, your budget can change with it. The discipline of using it remains the same.

"We must consult our means rather than our wishes."

- George Washington

Create a Habit: Quick-Start Onboarding & Accountability Plan

Getting a great household budget template is only the first step. Real change happens when you develop the habit of using it consistently. To help you do that, here’s a simple onboarding flow and accountability system you can follow with this template.

Use this plan as your self-leadership roadmap for the next two weeks. During week one, schedule time to complete the following six steps:

Step 1: Set Your Intentions and Download Your Tools

- Download the Household Budget Template in your preferred format (Excel or PDF).

- Write down 1–3 clear money goals for the next 90 days (for example: “Pay an extra $300 toward debt,” “Build a $500 emergency cushion,” or “Track every dollar for 30 days”).

- Decide when you’ll review your budget each week (pick a specific day and time).

Step 2: Gather The Numbers

- Collect the last 1–2 months of bank statements, credit card statements, and pay stubs.

- Make a simple list of your fixed bills (rent/mortgage, utilities, insurance, minimum debt payments) and your typical variable expenses (groceries, gas, eating out, etc.).

- Keep it simple; your goal is clarity, not perfection.

Step 3: Fill In Your Income and Fixed Expenses

- Enter all reliable sources of income in the Income section of the template.

- Enter your fixed monthly expenses with the best estimate you have.

- Look at the bottom line: are you running a surplus, breaking even, or running a deficit?

Step 4: Add Variable Spending and First Adjustments

- Enter your best estimates for variable categories (groceries, gas, dining out, entertainment, etc.).

- If you’re in the red, reduce a few flexible categories until your budget at least breaks even.

- Pick one “easy win” category where you’re willing to cut back this month (for example, eating out).

Step 5: Align Your Budget with Your “10 Steps to Conquer Debt”

- Review your debt-related goals and “10 Steps to Conquer Debt.”

- Add or adjust line items in your budget to reflect those goals (for example, “Extra debt payment” or “Emergency fund contribution”).

- Decide on a realistic extra amount you will put toward debt or savings this month, even if it’s small.

Step 6: Share Your Plan with an Accountability Partner

Choose someone you trust (spouse, partner, friend, or mentor) and share your main goals and your monthly budget. Ask them to:

- Check in with you once a week for the next month.

- Celebrate your progress and remind you of your goals if you drift.

- Agree on a specific check-in day and time (for example, Sundays at 5 PM by phone or text).

First Weekly Check-In

- Open your budget and update the actual amounts spent for the first week (or as much as you can).

- Compare “Planned” vs. “Actual” and note any categories where you overspent or underspent.

- Ask yourself: “What did I do well?” and “What will I do differently next week?”

Days 8–10: Small Daily Money Check-Ins (5 Minutes)

Each day, spend 5 minutes to:

- Record new transactions.

- Glance at your remaining amounts in key categories.

- Remind yourself of your top 1–2 money goals.

This is a self-leadership moment: you are training yourself to stay aware and intentional with every dollar.

Day 11: Mid-Month Adjustment

- Review your budget again: update actual income and expenses.

- If a category is clearly off (for example, groceries are much higher than planned), adjust the remaining weeks so your plan is realistic.

- Decide on one practical behavior change for the second half of the month (for example, “pack lunch 3 days a week” or “limit eating out to twice per week”).

Days 12–13: Review Progress with Your Partner

Have a quick conversation with your accountability partner:

- Share one win you’re proud of.

- Share one area you’re still struggling with.

- Confirm that you’re still on track with your next check-in date.

Remember: the goal is progress, not perfection.

Day 14: Monthly Reflection and Reset

At the end of the first full month, print or save your completed budget. Answer these reflection questions:

- What surprised me most about my actual spending?

- Which habits helped me stay on track?

- Where did I drift, and why?

- What will I change in next month’s budget?

Use your answers to create your next month’s budget in the same template, improving just 1–2 things at a time.

Suggested Accountability System (Use Every Month)

To turn this into a lasting self-leadership habit, keep this simple system going:

Daily (5 minutes):

Open your budget, record transactions, and glance at any category that tends to get out of control.

Weekly (15–20 minutes):

Do a short “Money Meeting” (alone or with your partner). Review:

- Planned vs. actual spending

- Any upcoming bills or irregular expenses

- One small improvement you’ll make next week

Monthly (30–45 minutes):

Complete your monthly reflection and set up the next month’s budget.

Revisit your “10 Steps to Conquer Debt” eBook and update your goals and extra payments as your situation improves.

Use this onboarding flow and accountability system alongside the Household Budget Template, and you’ll do far more than just “track numbers.” You’ll be leading yourself and your household toward greater clarity, confidence, and financial freedom - one intentional month at a time.

Continue Your Journey: Get the Full 10 Steps to Conquer Debt and Resource Library

Downloading this household budget template is a strong step. But it’s just one part of a complete path we’ve built to help you lead yourself to financial freedom.

At Leadership-Tools.com, you can access:

- The full “10 Steps to Conquer Debt” ebook – a practical, step-by-step guide that shows you how all the pieces fit together.

- A growing library of self-leadership resources – tools, worksheets, and training designed to help you lead yourself first, so you can lead others more effectively.

"Money is a terrible master but an excellent servant."

- P.T. Barnum

At first you might view the budgeting process as too simplistic, but keep in mind that you wouldn't be reading this if you didn't need to make some important financial changes.

Using our free household budget template and other financial tools, as you follow the steps that we have outlined, you will discover a renewed confidence and peace of mind as you manage your personal finances.

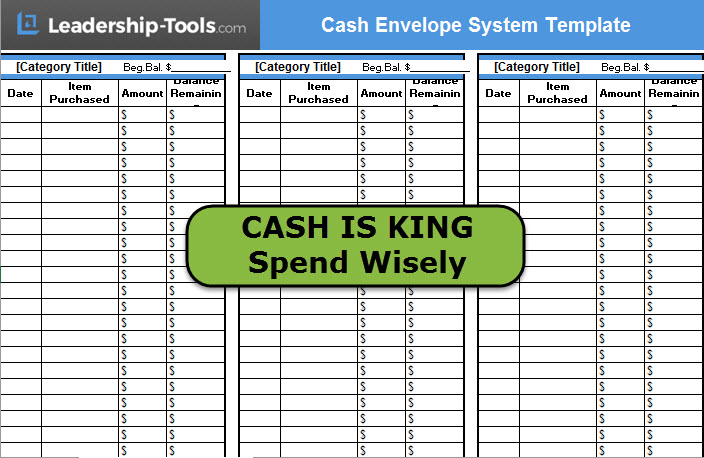

In Step Seven our ebook, 10 Steps to Conquer Debt, we'll provide another proven strategy that shows you how to ensure you never overspend – our Cash Envelope System is just one more arrow in your financial quiver to help you be successful.

Download 10 Steps to Conquer Debt eBook

Download the free ebook today: 10 Steps to Conquer Debt (PDF) Inside, you’ll discover additional practical tools and strategies that work hand‑in‑hand with this daily cash flow worksheet. Also, you can immediately download our free Household Budget Template: PDF | Excel File

To access all of our free leadership tools simply subscribe to our free newsletter. You will immediately receive a password that grants access to our entire leadership tools library.

Your privacy is important to us. We never share or sell email addresses